Deloitte and ArtTactic unveil 5th Art & Finance report

Services related to art and collectibles are now becoming a natural part of wealth managers’ service offering as wealth managers take a more holistic approach to their clients’ assets. This is one of the findings of Deloitte and ArtTactic’s Art & Finance report 2017.

The fifth edition of Deloitte and ArtTactic’s acclaimed report on the global art market and the art & finance industry was published today, six years after the first report became a reference in the art and finance industry. For the first time, almost nine out of ten of the wealth managers surveyed said art and collectibles should be included as part of a wealth management offering.

“It has been extremely interesting to study the development of wealth managers’ approach to services linked to art and collectibles over the last years. Art-secured lending, estate planning, art advisory and risk management are now offered by the majority of the wealth managers we surveyed. This can be explained by the fact that their wealthy clients spend an increasing part of their wealth on art and collectibles and expect these assets to be catered for by their trusted wealth advisers,” explains Adriano Picinati di Torcello, Director and Global Art & Finance coordinator at Deloitte, and co-author of the report.

Global art market back on track

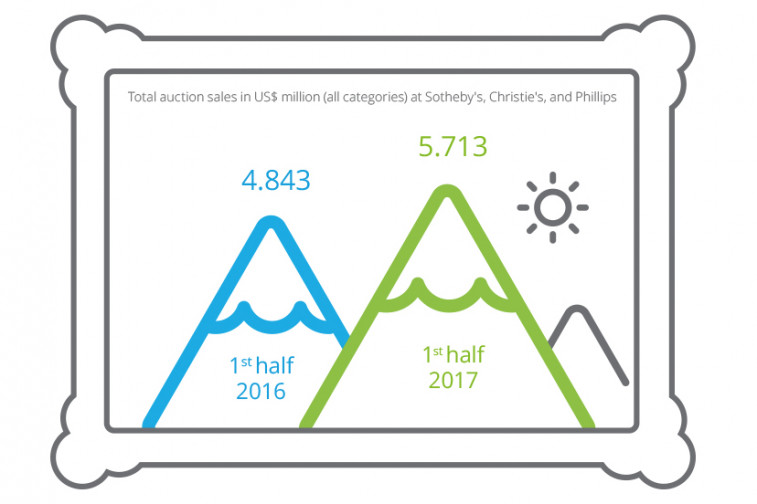

After a decrease in the global art market throughout 2016, auction sales have recovered in the first six months of 2017, and the art market has picked up in several regions. Given that the population of Ultra High Net Worth Individuals is expected to increase significantly in the coming decade, the long-term outlook for the art market looks positive. However, the current political and economic uncertainty may have a calming effect on the market in the short-term.

This year’s report is built on survey results encompassing around 350 survey respondents, including 69 private banks, 27 family offices, 155 art professionals and 107 art collectors. Moreover, 42 experts representing different aspects of the art or finance worlds have shared their insights through articles and interviews. The result is a comprehensive report which illustrates the trends and developments in the art and finance industry and the global art market in general.

More regulation good for business

The report highlights the intersection between art, finance and culture, and is structured around three main areas; art and wealth management, regulation, as well as technology and risk management.

The lack of regulations and transparency in the art market is a source of concern for three out of four wealth managers. On the other hand, art professionals and collectors join wealth managers in their call for the art market to modernize its business practices to meet the expected standards of a transparent, trustworthy and developed marketplace.

“While three out of four art professionals and collectors prefer self-regulation over government intervention, wealth managers call for more government regulations to reduce risks and to allow them to better navigate a market of which they often lack thorough knowledge,” explains Anders Petterson, Managing Director of ArtTactic and co-author of the report.

This sentiment of uncertainty, opacity and risk is further illustrated by the fact that half of the wealth managers surveyed listed lack of support from their leadership as a major challenge when it comes to developing art-related wealth services.

Tech as an enabler of the art and wealth market

Technology is increasingly playing a key role in the evolution of art wealth services. The report suggests that ArtTechs, including blockchain-based solutions, can open the door to new business models. Moreover, there is an uptick in tools that can be used for valuation, provenance and tracking, and thereby increase transparency and trust in the art market.

The Art & Finance report 2017 was launched today at the 10th Deloitte Art & Finance Conference in Milan, co-organized by Deloitte Luxembourg and Deloitte Italy with the support of Borsa Italiana. Top-notch speakers such as Dario Franceschini, the Italian Minister of Cultural Heritage and Aurélie Filippetti, former French Minister of Culture, shared their experiences with the Italian and French art markets respectively. This year’s Art & Finance conference was dedicated to Managing Private Art Collections & Corporate Collections of Family Businesses.

The full report can be downloaded from the Deloitte Luxembourg website at: www.deloitte.com/lu/art-finance-report

Communiqués liés

RSA launches technology and management liability insurance s...

RSA Luxembourg, part of Intact Insurance Specialty Solutions, today announces th...

Lancement d'une nouvelle connexion intermodale entre Bettemb...

CFL multimodal a le plaisir d'annoncer le lancement de sa nouvelle connexion i...

Experts from LUNEX award first micro-credentials in Rwanda o...

The Rwanda Ministry of Education (MINEDUC) formally inaugurated Syllabi, a publi...

ERG Notes that ENRC Secures Landmark Victory as Court of App...

Eurasian Resources Group (ERG), a leading diversified natural resources group he...

LetzToken et La Vie est Belle annoncent leur partenariat ouv...

«?LetzToken?», plateforme de tokenisation pionnière basée à Luxembourg, et ...

ERG announces a Pre-Export Finance Facility Agreement based ...

Eurasian Resources Group (“ERG”, “The Group”), a leading diversified nat...

Il n'y a aucun résultat pour votre recherche