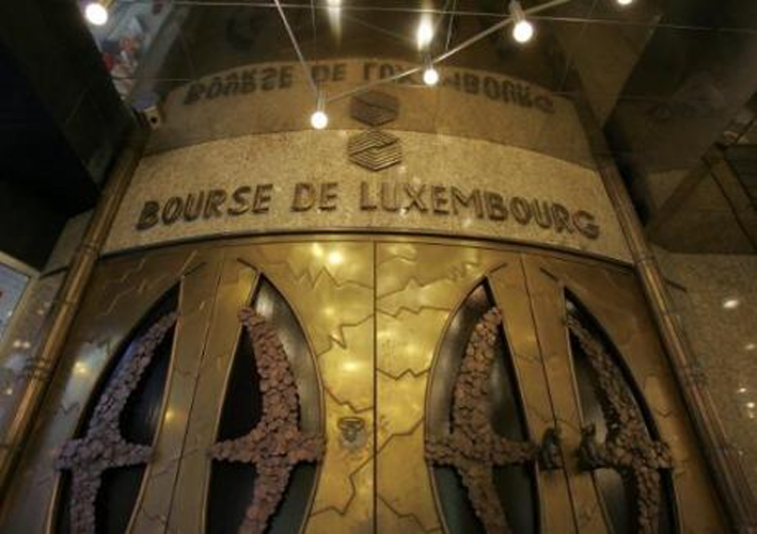

Luxembourg Stock Exchange Selects SWIFT for New Fund Market Infrastructure

The Luxembourg Stock Exchange has announced that it will use SWIFT in the development and rollout of its new market infrastructure for European investment funds.

We are very pleased that SWIFT will be cooperating with us on the completion of this important project. Industry players have long recognised the need for streamlining fund distribution processing and we very much support an efficient and fully-fledged market-driven solution. Ultimately, the fund market infrastructure will deliver a Luxembourg solution to the global fund distribution challenge

Dominique Valschaerts, member of the executive committee of the Luxembourg Stock Exchange

To be based in Luxembourg and expected to be launched in the third quarter of 2013, this infrastructure will provide the backbone of services for the cross-border distribution of funds in Europe and globally. Initially, these will include services for order management, such as order routing, as well as value-added information and reporting services.

The objective of the new infrastructure is to drive efficiency and standardization in the fund distribution space through a user-owned and governed market utility. The Luxembourg Stock Exchange is taking advantage of its knowhow as a market operator and the expertise and leadership of Finesti, its subsidiary for fund information, which has extensive information capabilities for the collection and dissemination of fund data and documents. SWIFT’s technology will be leveraged to build the technical platform to support the infrastructure.

Dominique Valschaerts, member of the executive committee of the Luxembourg Stock Exchange, said: “We are very pleased that SWIFT will be cooperating with us on the completion of this important project. Industry players have long recognised the need for streamlining fund distribution processing and we very much support an efficient and fully-fledged market-driven solution. Ultimately, the fund market infrastructure will deliver a Luxembourg solution to the global fund distribution challenge.”

Edward Glyn, Head of Funds, EMEA at SWIFT commented: "Powering critical market infrastructures with unparalleled performance has always been part of SWIFT’s DNA. We are extremely proud that The Luxembourg Stock Exchange has asked SWIFT to provide the operational backbone for its ambitious initiative. We share a common vision to further streamline multiple aspects of the funds distribution lifecycle to continually create value for our joint client base.”

The fund market infrastructure initiative is backed by a consultation group of major international participants operating in Luxembourg, Europe’s largest investment fund centre, which includes leading transfer agents and distributors involved in cross-border fund distribution.

Communiqués liés

Un résultat courant en hausse de 7,5 % par rapport à l’e...

Dans un climat incertain, Banque Raiffeisen reste fidèle à ses valeurs et à s...

NMB Bank brings East Africa’s first sustainability bond to...

Just over a year after listing the first Sub-Saharan Africa gender bond on the L...

Allen & Overy announces first promotions in Luxembourg for A...

Allen & Overy (A&O) has announced the promotion of two new partners, three new c...

Nearly 50% EMEA firms believe AML regulations need more clar...

Across the Europe, Middle East and Africa (EMEA) region, almost half of financia...

2023 : une année de transition et de transformation

Lors de l’Assemblée générale qui s’est tenue le 24 avril 2024, les acti...

Il n'y a aucun résultat pour votre recherche