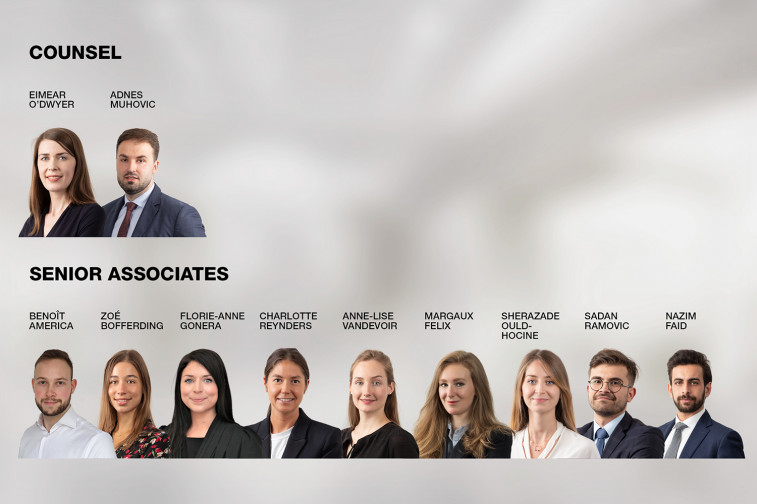

Clifford Chance appoints two counsel and nine senior associates in Luxembourg

Leading international law firm Clifford Chance today announces the promotion of two counsel and nine senior associates in Luxembourg.

Eimear O'Dwyer, counsel, Banking, Finance & Capital Markets: Eimear specialises in capital markets, securitisation and structured finance. She advises on a wide range of transactions including repackagings, securitisations, multi-source financings, MTN programmes and standalone bond issuances. She has also a particular interest in ESG matters.

Adnes Muhovic, counsel, Banking, Finance & Capital Markets: Adnes has extensive experience acting for both lenders and borrowers in national and cross-border finance work covering a wide range of debt financing practice areas, including general corporate lending, structured finance, asset finance, acquisition finance and real estate finance. He further specialises in unsecured and secured fund financings.

Benoît America, senior associate, Investment Funds: Benoît focuses on the regulatory framework associated with investment funds and their managers. This includes advising clients on AIFMD as well as other issues associated with, for example, ESG, MiFID, derivatives and securities lending.

Zoé Bofferding, senior associate, Investment Funds: Zoé advises domestic and international clients on the legal, regulatory, corporate and structural aspects of investment vehicles, with a particular focus on unregulated AIFs, SIFs and RAIFs with real estate, private equity, debt and fund of funds strategies.

Florie-Anne Gonera, senior associate, Investment Funds: Florie-Anne advises domestic and international clients on all legal, corporate and regulatory aspects in relation to the structuring, setting up and organisation of regulated and unregulated investment vehicles, with a particular focus on real estate, private debt and private equity funds.

Charlotte Reynders, senior associate, Investment Funds: Charlotte advises domestic and international clients on the structuring of investment vehicles with real estate, infrastructure, debt and private equity strategies. In addition, Charlotte is closely involved on fund financing facilities and investor's negotiation for development finance institutions.

Anne-Lise Vandevoir, senior associate, Investment Funds: Anne-Lise advises clients on legal, regulatory and organisational aspects of the structuring, management and servicing of both investment funds and investment funds managers. She has a strong focus on financial regulatory matters, including advising a wide range of regulated professionals of the Luxembourg financial sector.

Margaux Felix, senior associate, Banking, Finance & Capital Markets: Margaux specialises in national and cross-border banking and finance work, including acquisition finance, real estate finance and secured lending. She advises in particular funds, large international investment banks and Luxembourg banks on financing transactions for Luxembourg-based investment funds.

Sherazade Ould-Hocine, senior associate, Banking, Finance & Capital Markets: Sherazade focuses on, both domestic and cross-border transactions, including, in particular, real estate finance, asset finance, acquisition finance and general bank lending activities.

Sadan Ramovic, senior associate, Banking, Finance & Capital Markets: Sadan advises across the whole spectrum of lending activities and specialises in domestic and cross-border transactions, including, real estate finance, structured finance, asset finance and acquisition finance.

Nazim Faïd, senior associate, Corporate: Nazim focuses on M&A transactions, private equity, project and acquisition financing, complex restructuring and joint ventures. He also works with Fintechs on their M&A and joint-venture operations.

Commenting on these promotions Steve Jacoby, Managing Partner of Clifford Chance in Luxembourg, said: "Congratulations to these talented lawyers who have achieved this significant career accomplishment. Their promotion will further strengthen the position of our Luxembourg office in the banking finance, capital markets and investment funds practices and will be a great asset for our financial investors clients".

Communiqués liés

Apex Group boosts Saudi team with appointment of key executi...

Leading global financial service provider Apex Group has grown its team in the M...

Gcore raises $60 million in series A Funding to drive AI inn...

Gcore, the global edge AI, cloud, network, and security solutions provider, toda...

Luxair sélectionne le plus gros modèle des Boeing 737 MAX ...

Boeing et Luxair annoncent aujourd'hui que le transporteur régional européen c...

Global Wealth Report 2024 - La croissance revient à 4,2%, c...

Partout dans le monde, les gens s'enrichissent progressivement, et pas seule...

Luxair et lux-Airport font face à une panne technologique m...

Luxair et lux-Airport souhaitent informer le public sur la panne technologique m...

Apex Group Americas continues to expand its business develop...

Apex Group Ltd. (“Apex Group”) – global financial service provider - has a...

Il n'y a aucun résultat pour votre recherche