Fundsquare and Kurtosys tech partnership to facilitate asset management data disclosure

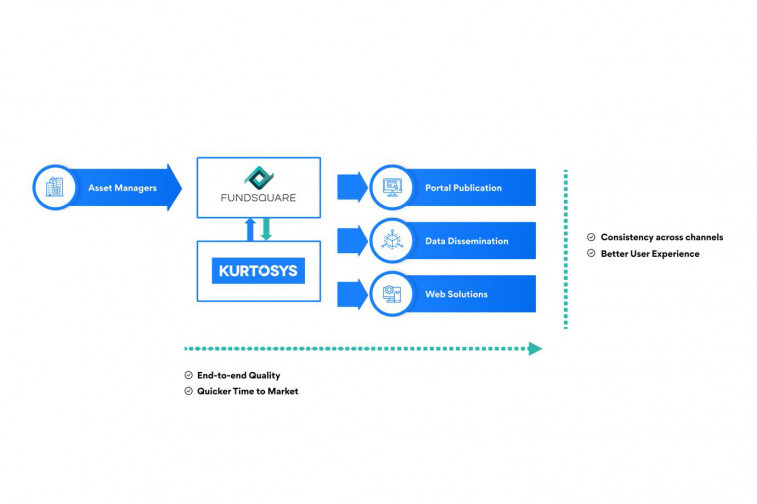

A new partnership announced today by Kurtosys and Fundsquare will enable asset managers to comply with data disclosure requirements, from dissemination to publication.

At the core of the innovative offering is a technical integration of the Fundsquare dissemination platform and the Kurtosys distribution cloud, which provides a unique suite of services combining the respective expertise of both systems.

“For our customers, data quality is one of the most common stumbling blocks in implementing a solution such as ours,” said Patrick McKenna, Global Head of Sales for Kurtosys. “This partnership will streamline the data integration process, giving our combined customers greater agility to address challenges within their distribution teams, whether to launch a new funds website, to better automate their sales materials, or to create an ESG reporting portal for their institutional clients.”

The combined solution aims to facilitate compliance with the regulatory framework for disclosure of information, shorten time to market for product launches, and improve the investor experience, while also saving operational and IT running costs.

“Our disclosure management offering is increasingly being used by asset managers to simplify their data distribution architecture and provide support to deal with the increasing complexity of data management,” said Didier Kayl, Head, Business & Relationship Development, Client Service Management, at Fundsquare.

The partnership comes at a time when asset managers are looking at both their cost base and operations in light of steadily declining fee revenue and the operational lessons learned during Covid.

In addition, recently announced changes to gold-plating requirements have offered asset managers the opportunity to create further efficiencies. The EU directive on cross-border distribution of investment funds from 12 July 2019 says member states should not require UCITS and alternative investment funds (AIFs) marketing in their country to have a physical presence or use an agent there. Instead, managers can use remote electronic communications, such as websites and microsites – solutions which are directly enabled by the combined offering.

Combined Model

The merits of this strategic alliance lie in the combination of two proven technology stacks and the respective expertise of both organizations that will provide tangible benefits to their community of mutual customers. Asset Managers will benefit in the following ways.

- Allow multi-source and multi-channel controls on data

- Drive down time to value on critical sales enabling initiatives

- Comply more easily with the regulatory framework for disclosure of information

- Guarantee end-to-end transparency and control over data life cycle, up to the investor

- Experience significant reductions in data publication issues

- Reduce significantly time to market during product launches

- Foster operational and IT running costs savings

Communiqués liés

Apex Group boosts Saudi team with appointment of key executi...

Leading global financial service provider Apex Group has grown its team in the M...

Gcore raises $60 million in series A Funding to drive AI inn...

Gcore, the global edge AI, cloud, network, and security solutions provider, toda...

Luxair sélectionne le plus gros modèle des Boeing 737 MAX ...

Boeing et Luxair annoncent aujourd'hui que le transporteur régional européen c...

Global Wealth Report 2024 - La croissance revient à 4,2%, c...

Partout dans le monde, les gens s'enrichissent progressivement, et pas seule...

Luxair et lux-Airport font face à une panne technologique m...

Luxair et lux-Airport souhaitent informer le public sur la panne technologique m...

Apex Group Americas continues to expand its business develop...

Apex Group Ltd. (“Apex Group”) – global financial service provider - has a...

Il n'y a aucun résultat pour votre recherche