Deloitte: Wealth management industry is taking a more strategic view on art as an asset class, according to Deloitte and ArtTactic’s third Art & Finance report

“The wealth management industry is clearly taking a more strategic view on art as asset class and how it could be used as a tool to build stronger and deeper relationships with clients, in an increasingly competitive market place.” This is one of the major conclusions of the Art & Finance report’s 2014 edition, published by the audit and consulting firm Deloitte Luxembourg in conjunction with ArtTactic, which has examined the industry’s development over the past 12 months.

While last year’s report identified an increasing interest of the wealth management community towards the art market, this third edition confirms the positive development of the art and finance industry, particularly driven by the global art market growth and a global growth in wealth

Adriano Picinati di Torcello, Director at Deloitte Luxembourg

Art as a key element of asset diversification strategies

“While last year’s report identified an increasing interest of the wealth management community towards the art market, this third edition confirms the positive development of the art and finance industry, particularly driven by the global art market growth and a global growth in wealth.” states Adriano Picinati di Torcello, Director at Deloitte Luxembourg coordinating the Art & Finance practice and the co-author of the Art & Finance report’s 2014 edition.

This year’s findings suggest that art buyers and collectors are acquiring art and collectibles with an investment view (76%, compared to 53% in 2012) which will increase the need and demand for professional and wealth management services linked to management and planning, preservation, leverage and enhancement of art and collectible assets.

It seems that the wealth management community is already responding to this new demand, with 88% of the family offices and 64% of the private banks surveyed saying that estate planning around art and collectibles is a strategic focus in the coming 12 months. This highlights that art related tax, estate and succession planning issues are increasingly becoming a hot agenda topic.

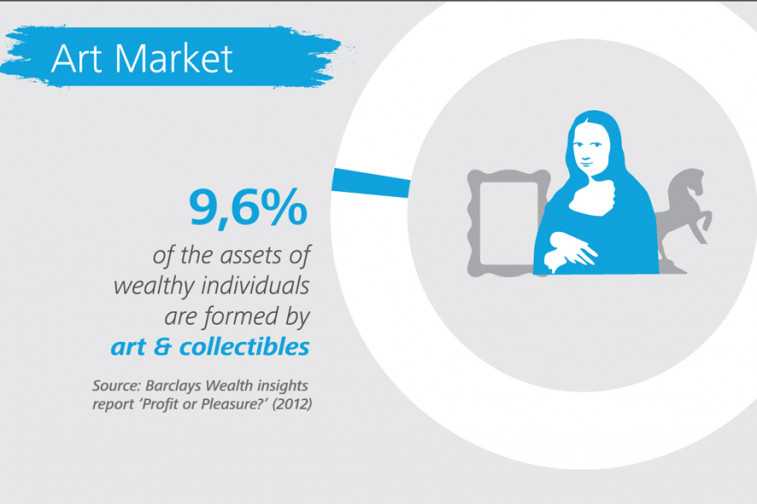

Also, 50% of the family offices surveyed stated that one of the most important motivations for including art and collectibles in their service offering was due to the potential role it could play in a balanced portfolio and asset diversification strategy.

Art fund industry to rethink its current model

“Confidence in the art fund industry is mixed. The majority of art professionals and art collectors surveyed believe the art fund industry will expand in the next 2-3 years but wealth managers remain still very cautious as issues such as due diligence, lack of liquidity, valuation, lack of track records and unregulated market weigh negatively on these types of investment products. The art fund industry may have to rethink its current model to incorporate the reasons why art investors buy art in the first place.” explains Vincent Gouverneur, Partner and leader of the Art & Finance practice at Deloitte Luxembourg.

Technology as a main asset

New tools created by technology-driven companies and online market places will undeniably play an increasingly important role in the art and finance industry. This opinion is shared by 77% of the art collectors and nearly 70 % of the art professionals, who believe that the online auction art market will become one of the winning business models.

“Technology-driven and online art businesses have a clear potential to support the development of the art and finance industry, particularly through increased liquidity, lower transaction costs and more transparency. The advent of digitisation of more art related data and the ability of technology to process this data could bring significant improvement and potential standardisation around valuation methods and processes in the future”, states Anders Petterson, Managing Director of ArtTactic.

M&A activity is also likely to pick up as the online industry matures. With the number of online art market places and online auctions multipliying, one would expect consolidation to take place in the future, opening up opportunities around art and corporate finance.

Freeports to become strategic hubs

Freeports as competence clusters have the potential of becoming important hubs for the art and wealth management industry, offering them the possibility to develop regional competence centres around these assets. This is especially the case with Luxembourg, Singapore and Switzerland.

In this context, continuing to build closer relationships between art professionals and the wealth management community could be an effective way to grow the art and finance industry. In addition to that, a certain level of regulation in the art market would not only be helpful for the art and finance industry, but also for the art market as a whole.

The complete version of the report, which has been presented at the 7th annual Art & Finance conference in Luxembourg, can be downloaded from the Deloitte Luxembourg website, at: www.deloitte.com//lu/artandfinance/report2014

Communiqués liés

La réponse de Luxair aux défis de brouillage GPS

Récemment, des incidents de brouillage GPS ont été signalés dans l'industrie...

Drees & Sommer chez 10x6 : Aperçu de la vision du New Europ...

Drees & Sommer Luxembourg a le plaisir d'annoncer sa participation à l'événem...

Un résultat courant en hausse de 7,5 % par rapport à l’e...

Dans un climat incertain, Banque Raiffeisen reste fidèle à ses valeurs et à s...

NMB Bank brings East Africa’s first sustainability bond to...

Just over a year after listing the first Sub-Saharan Africa gender bond on the L...

Allen & Overy announces first promotions in Luxembourg for A...

Allen & Overy (A&O) has announced the promotion of two new partners, three new c...

Il n'y a aucun résultat pour votre recherche