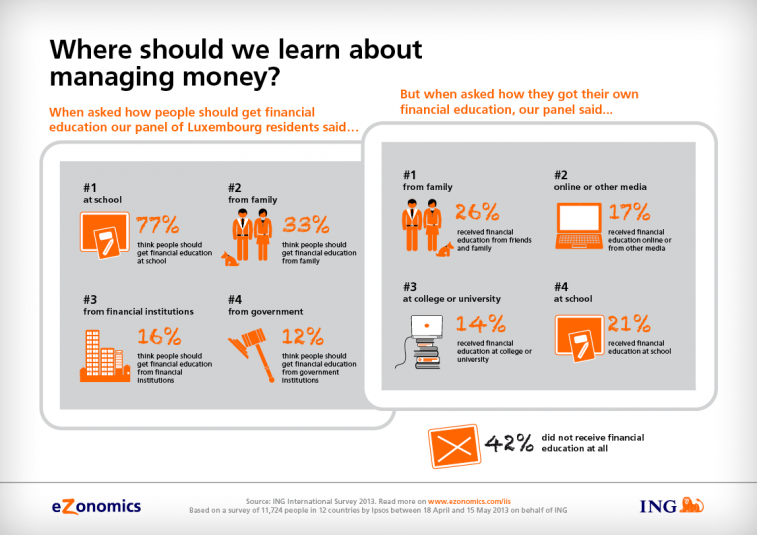

According to ING International Survey, only 21% of Luxembourg residents have received financial education at school!

The objective of ING International Survey is to gain a better understanding of customers’ needs

and expectations.

The role of school in financial education

To the question “Do you think that citizens should receive a financial education?”, 77% of Luxembourg residents think that this type of education should be given at school, which is very close to the European average, at 76%!

However, in reality, only 21% of Luxembourgers have received this education at school, compared to 13% for the European average. With this percentage, the Grand-Duchy ranks second after Austria (score of 25%).

Importance of parents, friends and self-learning

Following the question about the other sources of education than school, that respondents used to acquire or improve their financial skills:

- 26% of Luxembourg respondents mentioned their family and friends (compared to 20% for the European average)

- 17% mentioned self-learning via Internet and other media (like the European average) and 11% via specialized books (11,2% for the European average)

The other means to get a financial education

Finally, to the question to know by which means, except school, Luxembourg residents should be able to acquire financial education:

- 33% mention family and friends (compared to 35% for the European average)

- 12% mention government institutions (compared to 15% for the European average)

- 16% mention financial institutions (compared to 20% for the European average)

For consumers, financial education is important because it helps them to manage their finance by making informed choices, thanks to good trainings and reliable quality information!

A sound understanding of the concepts and reasoning behind financial education helps not only to efficiently manage finance either for current spending (clothes, leisure, etc.) or for big spending (cars, holidays…) but also to manage risks when investing, for example.

ING has realized how important it is for consumers to have a good financial education, and created the Internet site www.ezonomics.com and ING International Survey (IIS) in 2012.

Communiqués liés

La réponse de Luxair aux défis de brouillage GPS

Récemment, des incidents de brouillage GPS ont été signalés dans l'industrie...

Drees & Sommer chez 10x6 : Aperçu de la vision du New Europ...

Drees & Sommer Luxembourg a le plaisir d'annoncer sa participation à l'événem...

Un résultat courant en hausse de 7,5 % par rapport à l’e...

Dans un climat incertain, Banque Raiffeisen reste fidèle à ses valeurs et à s...

NMB Bank brings East Africa’s first sustainability bond to...

Just over a year after listing the first Sub-Saharan Africa gender bond on the L...

Allen & Overy announces first promotions in Luxembourg for A...

Allen & Overy (A&O) has announced the promotion of two new partners, three new c...

Il n'y a aucun résultat pour votre recherche