KPMG Survey: Impacts of the regulatory challenges on the business and operating models of Management Companies in Luxembourg

KPMG surveyed management companies (this sector covers around 2300 jobs in Luxembourg - source : CSSF) last year on their current situation and expected future evolutions on following themes: strategy, operating model, IT systems and alignment towards regulatory changes.

Management companies: consolidate or move abroad? Which strategy in Luxembourg?

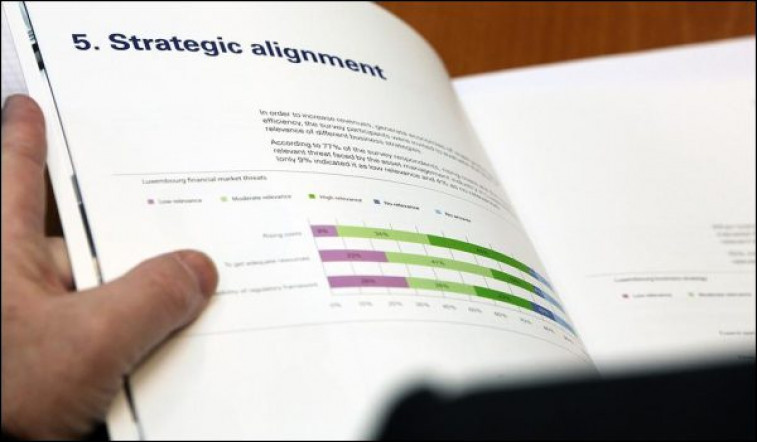

From a strategic point of view, Luxembourg does not need to worry as regards the growth of this sector, as a vast majority of respondents consider the expansion of their operations in Luxembourg as the most relevant strategy against only 4% thinking of closing operations. On the downside, two major threats have been identified as the most worrisome, namely

- rising costs and

- the difficulty to get adequate resources.

Unsurprisingly, outsourcing solutions and internal cost reduction programs are viewed by a majority of participants, respectively 58% and 50%, as the most relevant answers to those threats.

Another consequence of the increasing costs is the necessity acknowledged by many companies to review their pricing and margin structure (73%) as well as their clients’ portfolio by focusing on valuable groups (57%).

Outsourcing or Insourcing? Consequences of regulations

With regards to their operating model, nearly 80% of companies have outsourced some of their activities, this being particularly true for small companies. Yet, the upcoming regulatory evolutions and notably those aiming at reinforcing the accountability of management companies tend to reverse the sourcing trend. On average the proportion of in-sourced activities is deemed to increase from 22% currently to 48%, this being one of the ways companies will bring more substance to their business. The main challenge they will encounter is to find the right balance between the costs of in-sourcing and the compliance with the new regulatory requirements.

Investments on the IT side: challenges and opportunities

On the IT side, we notice that small-sized companies allocate to their IT proportionally nearly half of the budget allocated by larger companies (8% of total budget vs. 15%) and globally the biggest part (72%) of the IT budget is dedicated to “running the company”, leaving little financial capacity for investment in improvement and transformation projects. The application landscape of management companies still consists for a large part in simple tools like MS office for their activities, legal being the activity least supported by vendor or in-house systems mainly concerning prospectus maintenance (62%).

Larger companies tend on the other hand to be well equipped in systems as regards key activities like portfolio risk management, compliance, production of KIIDs… These domains are also the ones in which the market of service providers is most mature. It is worth pointing out that many participants (41% of the small and 31% of the large companies) were not able to indicate the type of system they are using.

This reflects a certain level of opacity pertaining to outsourced activities and the tools used by the service providers. The level of satisfaction of respondents in their IT systems is rather high with only 3% being dissatisfied with their current IT solutions. Among the few participants (8%) confirming their intention to change their IT solutions in the coming two years the system that is most frequently mentioned is the portfolio risk management tool.

Conclusion: what is the future for management companies?

Management companies are facing huge challenges mainly driven by new regulations. Many strategic, operational and IT decisions will have to be taken in order to be compliant while trying to maintain or raise cost-income ratio at an acceptable level. Yet, the regulatory evolutions are also offering opportunities for further expansion of the activities of the management companies. For instance, the new substance requirements for management companies bring about positive evolution, as far as they further strengthen investor protection and therefore facilitate the registration of such funds for sale in new and existing distribution countries. No doubt Luxembourg will again demonstrate its capacity to overcome the obstacles and benefit from the opportunities lying ahead.

Communiqués liés

La réponse de Luxair aux défis de brouillage GPS

Récemment, des incidents de brouillage GPS ont été signalés dans l'industrie...

Drees & Sommer chez 10x6 : Aperçu de la vision du New Europ...

Drees & Sommer Luxembourg a le plaisir d'annoncer sa participation à l'événem...

Un résultat courant en hausse de 7,5 % par rapport à l’e...

Dans un climat incertain, Banque Raiffeisen reste fidèle à ses valeurs et à s...

NMB Bank brings East Africa’s first sustainability bond to...

Just over a year after listing the first Sub-Saharan Africa gender bond on the L...

Allen & Overy announces first promotions in Luxembourg for A...

Allen & Overy (A&O) has announced the promotion of two new partners, three new c...

Il n'y a aucun résultat pour votre recherche