Concerns about the global banking system being at risk from failure of economic recovery

‘Banana Skins’ poll identifies top threats to banks. Concerns about possible failure of the global economic recovery and the damage this would do to a still fragile banking system is growing, reveal findings from a survey on global banking risk.

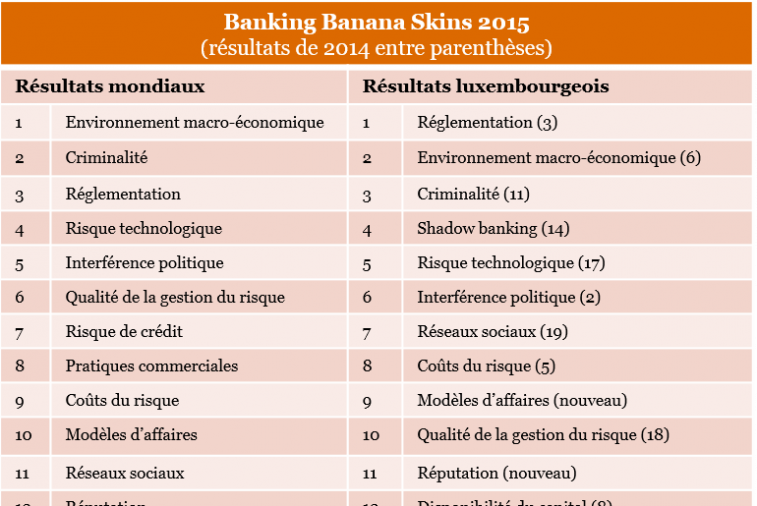

Results from the CSFI’s latest global annual survey, conducted in association with PwC, ‘Banking Banana Skins 2015’, puts concern about the macro-economic environment at the top of the list of 24 possible risks to banks, knocking down excessive regulation, long a high-ranking risk in this years’ survey. The poll is based on responses from more than 670 bankers, banking regulators and close observers of the banking industry in 52 countries. In Luxembourg, 28 players from the banking industry, including CEOs, risk managers and compliance officers, shared their views on potential risks looming on the horizon.

The voice is raised to “less but better regulation”

Concern about regulatory excess dominated the response from Luxembourg participants. Some participants noted that the regulator should find a better balance between regulation and the economic effects on a bank's business (and thus viability). Although this risk is at the top position of the 24 risks, there is a shift towards a more nuanced view, compared to the previous survey, which accepts the need for tougher controls, though also questions their costs and effectiveness.

“The concern about the cost of regulation has to be taken seriously, explains Olivier Carré, partner and Banking Leader at PwC Luxembourg. With the rise of FinTech companies playing in the same market segment but not with the same rules, the regulators have to foster a more balanced level playing field to ensure sustainable business models.”

Uncertain macro-economic environment threatens bankers

The uncertainties in the macro-economic environment present a main threat to the recovery of the global banking system, ranked no.2 by Luxembourg participants.

Concerns about the macro-economic environment outlook was also high, both globally and in Luxembourg. There are many reasons for this including: the high level of debt that persists in all the main sectors of the world - sovereign, corporate and consumer - and the big question mark over the future of quantitative easing and interest rates.

“Viability and sustainability of bank’s business models is actually the first pillar of the supervisory assessment of the European Central Bank (the so-called “SREP”) where the ECB also show its concerns about the current low interest rates”, adds Emmanuelle Henniaux, partner at PwC Luxembourg, in charge of Risk Management services.

Criminality concern surges

Luxembourg banks are also highly vulnerable to the growth in financial crime, particularly cybercrime, which has surged as a concern from the no.11 position last year to no.3 this year. This is also a global concern as cyber criminals target the weak links in a closely interwoven worldwide banking system. The change in the client interaction (online banking) and the ability of banks to manage the growth in crime is also under question, as shown by strong concern about the quality of their technology (no.5) and of their risk management systems (no.10).

Other risks

Another fast-rising concern is the growth of shadow banking (from no.14 to no.4), both in the form of non-financial institutions (e.g. funds) entering bank territory and Fintech companies providing banking-type services without covering the full value chain. This trend is being enhanced by the strict capital rules.

In contrast to other countries, Luxembourg saw fewer risks from credit problems (no.17) and emerging markets (no.22) because of lower exposure.

Other high concerns include:

- Human resources – respondents expressed their concern about tapping into young talent, who usually do not favour a sector of the economy which reputation has been damaged further to the global financial crisis.

- Social media - bankers are still cautious about the use of social media as they see it as unpredictable and they can hardly manage messages.

The Banking Banana Skins Survey is available on PwC Luxembourg’s website.

Communiqués liés

Réseau ETRE est le nouveau lauréat du Degroof Petercam Fou...

Réseau ETRE remporte la sixième édition du Degroof Petercam Foundation Award....

Le Groupe ALIPA accueille une étudiante dans le cadre du Jo...

ALIPA Group, spécialiste du levage et de l’emballage industriel, a accueilli ...

Quintet lance le premier d’une série de nouveaux fonds e...

La banque privée européenne lance un fonds d’actions américaines sous gesti...

Gcore opens the first H100-based data center in Korea - Part...

Gcore the global edge AI, cloud, network, and security solutions provider, will ...

ALD Automotive Luxembourg devient Ayvens

ALD Automotive / Leaseplan dévoile aujourd'hui Ayvens, sa nouvelle marque de mo...

Eurasian Resources Group to Donate 500 Million Tenge to Floo...

Eurasian Resources Group (ERG), a leading diversified natural resources group he...

Il n'y a aucun résultat pour votre recherche