KPMG releases Luxembourg Banks – Insights 2013

“Survival in a demanding environment”.

Banking secrecy was a stumbling block in establishing Luxembourg as a brand – so much time and energy was spent defending the policy internationally that Luxembourg had little chance to promote its other merits. With such a hurdle out of the way, we can finally start the very real and pressing task of branding Luxembourg

Georges Bock, KPMG Managing Partner

Now the final banking results are in for 2012, it is time to take a closer look at the figures. Banking income has shot up by 10%, a sprint finish surpassing 2009 levels. Even more positively, net profit has leapt up to €3.5 billion, a jump of 42% from a year ago. So with such healthy figures on the revenue side, are we seeing a full recovery? “Hold the champagne.” says KPMG Managing Partner Georges Bock.

Luxembourg Banks- Insights 2013, KPMG’s in-depth analysis of the banking industry, reveals that rather than growth, the real factors behind this year’s profits were improved market conditions and a reversal of prior year provisions. The full story from Luxembourg’s banks is actually quite mixed as recurring revenues decreased.

As part of the analysis, KPMG spoke to Luxembourg’s top banking professionals and asked them to answer, for both themselves and on behalf of their clients, “Why Luxembourg? How to adapt?”. Time after time, Luxembourg’s financial stability topped the table as the greatest draw for clients and banks alike. This straw poll was among those who have already understood what Luxembourg has to offer, however KPMG Luxembourg’s Georges Bock thinks there may still be some work to be done to spread this message.

“Banking secrecy was a stumbling block in establishing Luxembourg as a brand – so much time and energy was spent defending the policy internationally that Luxembourg had little chance to promote its other merits. With such a hurdle out of the way, we can finally start the very real and pressing task of branding Luxembourg.”

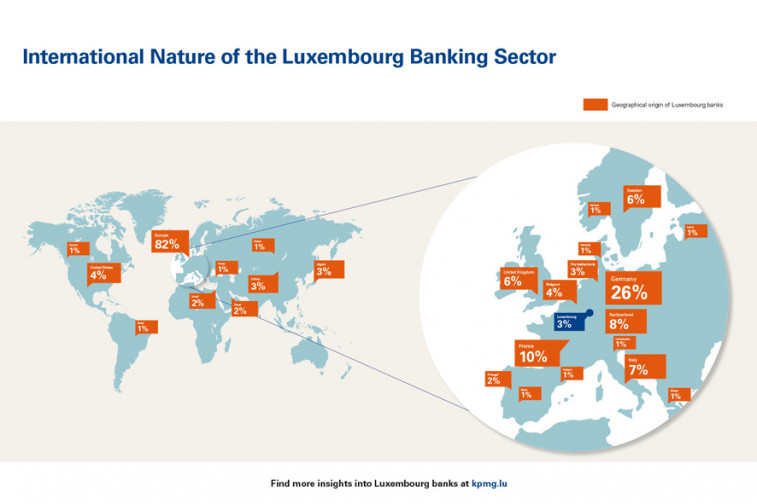

Luxembourg Banks - Insights 2013 features a range of infographics illustrating that Luxembourg has much to be proud of in terms of its banking sector, especially with regards to its international nature. Whether the industry will be able to capitalize on its solid foundations going forward will depend on its ability to innovate, adapt and change mindset.

For more information and a full copy of the publication, please consult the KPMG website.

Communiqués liés

Gcore Recognised as Highly Commended in the Industry Innovat...

Gcore acknowledged for successful launch of first AI speech-to-text solution for...

MOMENTUM 2024 drives sustainable solutions forward

Deloitte’s annual MOMENTUM Conference fosters a dynamic exchange between indus...

Nouvelle recrue au service client de NO-NAIL BOXES : Nadine ...

NO-NAIL BOXES, le fabricant luxembourgeois de caisses pliantes en bois contrepla...

Réseau ETRE est le nouveau lauréat du Degroof Petercam Fou...

Réseau ETRE remporte la sixième édition du Degroof Petercam Foundation Award....

Le Groupe ALIPA accueille une étudiante dans le cadre du Jo...

ALIPA Group, spécialiste du levage et de l’emballage industriel, a accueilli ...

Quintet lance le premier d’une série de nouveaux fonds e...

La banque privée européenne lance un fonds d’actions américaines sous gesti...

Il n'y a aucun résultat pour votre recherche