LuxSE to further facilitate access to China Interbank Market

The Luxembourg Stock Exchange (LuxSE) joins forces with Shanghai Clearing House and China Construction Bank to facilitate access to financial information on Chinese securities, while simplifying the execution process.

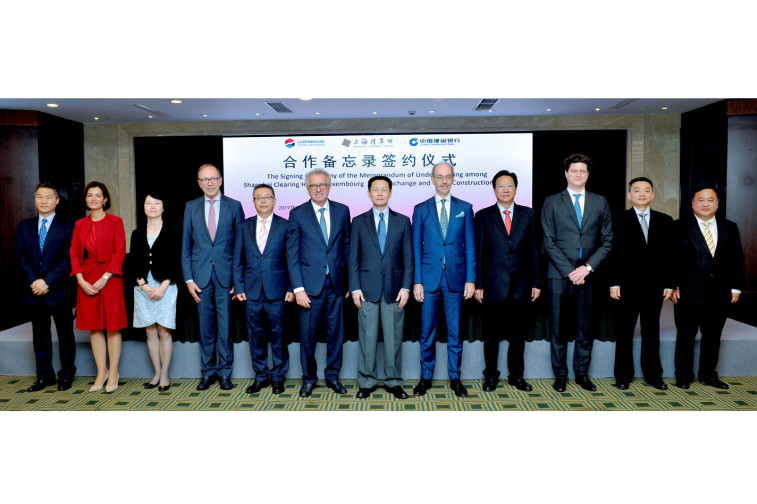

The official signing ceremony took place in Shanghai on 18 September 2019, in the presence of H.E. Mr. Pierre Gramegna, Luxembourg Minister of Finance, representatives of the Luxembourg financial centre, and the three institutions’ senior leadership teams.

“Data play an essential role in green finance and in capital markets more generally. Investors need reliable and complete information on which to base their investment decisions. With this agreement, our three institutions will work together to close the information gap that keeps many international investors from entering the China Interbank Market,” announced Robert Scharfe, CEO of the Luxembourg Stock Exchange.

Facilitating access and understanding

The objective of the tripartite Memorandum of Understanding is to establish a cross-border collaboration related to securities traded on the China Interbank Market, with a specific focus on green securities.

The Luxembourg Stock Exchange will display information on securities cleared through Shanghai Clearing House, to facilitate access to the China Interbank Market for the international investor community. Shanghai Clearing House will provide the relevant information on the securities falling under the scope of the agreement, while China Construction Bank will act as the primary partner for related investor services.

The overarching objective of the agreement is to promote the China Interbank Market and pave the way for international investors by removing some of the obstacles related to accessing financial information, and by simplifying cross-border transactions. By displaying information in English about securities cleared through Shanghai Clearing House, the Luxembourg Stock Exchange will contribute to making essential financial information on Chinese securities more accessible to international investors, and thereby smooth the path to potential new investment opportunities.

Increasing the scope

In 2018, the Luxembourg Stock Exchange established a Green Bond Channel together with the Shanghai Stock Exchange. This initiative was an important step towards facilitating access to information on Chinese securities listed on the Shanghai Stock Exchange. This week’s agreement with Shanghai Clearing House and China Construction Bank is thus an expansion of this initiative, increasing the scope of information provided to also include data about securities cleared at the Shanghai Clearing House.

“This agreement will open a new chapter in the China Interbank Market cross-border cooperation by leveraging the advantages of the three institutions in cross-border market resources, product development and marketing, and clearing and settlement facilities. We will promote innovation in cross-border bond index products, cross-border collateral management, and facilitate cross-border issuance and listing,” said Mr. Xie Zhong, Chairman of Shanghai Clearing House.

The three parties were unified in their message of cooperation and expressed a shared objective of furthering economic development.

“This cooperation will help to connect issuers and investors in both China and Europe, facilitate the opening-up of the Chinese bond market, and enhance the integration of China into the world’s capital markets, which in turn will bring benefits for all. Under the current global economic context marked by complexity and uncertainty, opening-up and cooperation are the only ways forward,” commented Mr Huang Yi, Executive Vice President at China Construction Bank.

Communiqués liés

Réseau ETRE est le nouveau lauréat du Degroof Petercam Fou...

Réseau ETRE remporte la sixième édition du Degroof Petercam Foundation Award....

Le Groupe ALIPA accueille une étudiante dans le cadre du Jo...

ALIPA Group, spécialiste du levage et de l’emballage industriel, a accueilli ...

Quintet lance le premier d’une série de nouveaux fonds e...

La banque privée européenne lance un fonds d’actions américaines sous gesti...

Gcore opens the first H100-based data center in Korea - Part...

Gcore the global edge AI, cloud, network, and security solutions provider, will ...

ALD Automotive Luxembourg devient Ayvens

ALD Automotive / Leaseplan dévoile aujourd'hui Ayvens, sa nouvelle marque de mo...

Eurasian Resources Group to Donate 500 Million Tenge to Floo...

Eurasian Resources Group (ERG), a leading diversified natural resources group he...

Il n'y a aucun résultat pour votre recherche