Armacell H1 2019 Results

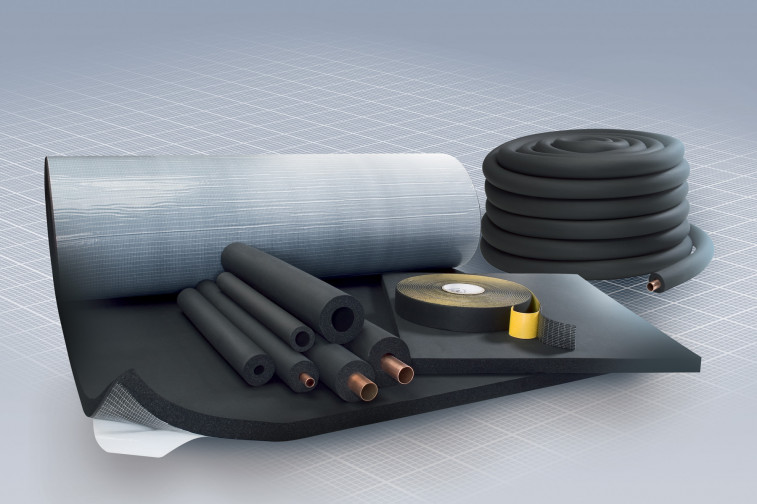

Armacell, a global leader in flexible foam for the equipment insulation market and a leading provider of engineered foams, announced its H1 2019 results on 15 August 2019.

During the first six months of 2019, Armacell generated record net sales of EUR 321.8 million, up by 6.3% compared to the previous year’s first half on a like-for-like basis (H1 2018: EUR 302.7 million). The net sales growth was mainly driven by volume growth in the Advanced Insulation business and by the fast-growing global PET business.

Adjusted EBITDA grew to EUR 63.4 million in H1 2019 (H1 2018: EUR 50.6 million). The adoption of IFRS 16 accounted for EUR 6.0 million for the first six months 2019. The adjusted EBITDA margin reached 19.7%.

Commenting on the company’s financial performance, Patrick Mathieu, President & CEO of the Armacell Group, said: “Overall, our strategy is on track and we continue to generate a strong organic growth performance. The significant investments we made in the three regions we operate in and across both business divisions, Advanced Insulation and Engineered Foams, contributed positively to our results and will drive our business forward as we proceed through 2019.”

In April 2019, Armacell and Thermaflex signed a commercial co-operation agreement to jointly serve the Russian market. As part of this agreement, the enlarged customer base will benefit from a combined elastomeric and thermoplastic product offering and enhanced customer service levels.

In H1 2019, Armacell continued to focus on the sales deployment and capacity expansion of ArmaGel – the company’s next generation aerogel blanket technology – and PET foams. The latter was characterised by the development of additional PET production capacity in China to further strengthen Armacell’s leadership in the APAC region.

Dr Max Padberg, CFO of the Armacell Group, commented: “In the first six months of the year, Armacell achieved a positive operating free cash flow and significantly reduced the net debt position to EUR 609 million (December 2018: EUR 623 million) and improved the leverage ratio to 5.4x (December 2018: 5.9x). Post IFRS 16, the net debt to EBITDA ratio equates to 5.1x.”

Armacell is rated B (stable) by Standard & Poor’s and B3 (stable) by Moody’s.

Communiqués liés

2023 : une année de transition et de transformation

Lors de l’Assemblée générale qui s’est tenue le 24 avril 2024, les acti...

Cargolux posts profit for 2023

The Cargolux Group (Cargolux) generated a positive net result for its 2023 finan...

Gcore Recognised as Highly Commended in the Industry Innovat...

Gcore acknowledged for successful launch of first AI speech-to-text solution for...

MOMENTUM 2024 drives sustainable solutions forward

Deloitte’s annual MOMENTUM Conference fosters a dynamic exchange between indus...

Nouvelle recrue au service client de NO-NAIL BOXES : Nadine ...

NO-NAIL BOXES, le fabricant luxembourgeois de caisses pliantes en bois contrepla...

Réseau ETRE est le nouveau lauréat du Degroof Petercam Fou...

Réseau ETRE remporte la sixième édition du Degroof Petercam Foundation Award....

Il n'y a aucun résultat pour votre recherche