According the ING International Survey special report on « helicopter money », 37% of Luxembourg residents think that receiving money from the central bank will not have any impact on the economy

What is helicopter money?

The term ‘helicopter money’ was first coined by the economist Milton Friedman in a 1969 paper entitled The Optimum Quantity of Money. It has been mooted by economists more recently as a step beyond Quantitative Easing, which some argue is more beneficial to the asset-wealthy.

The theory is that, with extra money to spend, or fewer taxes to be paid, households would consume more, boosting business activity and employment. Higher inflation expectations could also give consumers an incentive to consume.

Friedman envisaged directly distributing money to communities but other methods of monetary financing such as ‘direct deficit financing’, whereby money is used to finance government spending, or to fund infrastructure, are also possible.

The survey results for Luxembourg

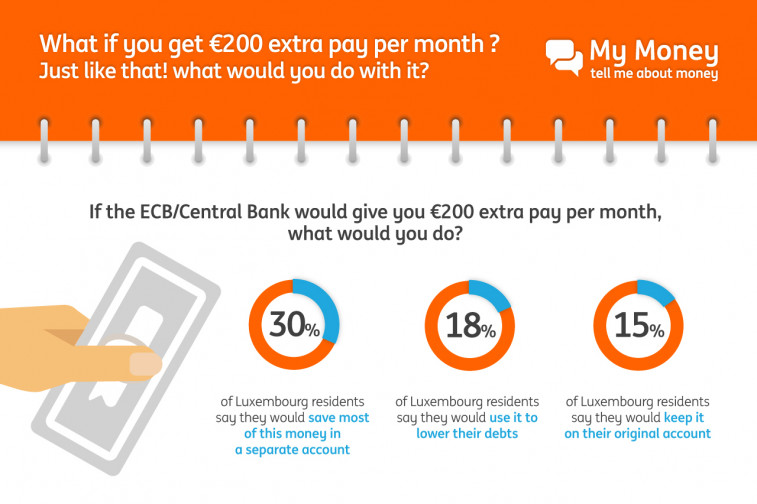

If the European Central Bank would give €200 extra pay per month, less than a quarter (21%) of Luxembourg consumers surveyed said they would spend ‘most’ of the money, whereas this would be 26% amongst European consumers.

Nearly one third (30%) of the Luxembourg respondents said they would save most of this money in a separate account, 15% said they would keep it on their original account while 18% said they would use it to lower their debts.

When comparing between nationalities in the Grand Duchy, 13% of national residents and 8% of foreign residents said they would spend the money on necessary items (e.g. rent, mortgage, food, insurance), this is the opposite for non-necessary items, 9% of nationals and 13% of foreigners would be spending the extra pay on holidays, going out, etc.

Less than half (41%) of Luxembourg consumers think helicopter money would be a ‘good idea’, whereas 21% consider it a ‘bad idea’.

Ian Bright, senior economist at ING, commented:

“Despite the positive intention behind helicopter money, our research among consumers in Europe suggests that they would spend only a small part of the money handed to them. Both direct higher government spending or handing out time-limited spending coupons might be considered as alternatives, although our study did not test their potential effectiveness.”

Ian Bright will intervene during the 8th edition of the “Luxembourg Finance Summit” on 15 November 2016 with a presentation entitled “Consumer financial fragility and the next financial crisis”.

More information at eZonomics.com: https://www.ezonomics.com/ing_international_surveys/helicopter-money-2016/

Communiqués liés

Les expatriés au Luxembourg satisfaits de leur décision d'...

87% des expatriés au Luxembourg sont satisfaits de leur décision d'expatriatio...

Le Luxembourg aime la banque digitale

75 % des personnes interrogées au Luxembourg attendent des banques qu’elles l...

ING - une retraite hors de portée pour certains au Luxembou...

57% des résidents luxembourgeois craignent de manquer d’argent à la retraite...

ING parmi les meilleurs innovateurs digitaux

Chez ING, nous nous efforçons d'innover dans la poursuite d'une expérience à ...

L'économie collaborative au Luxembourg engendre 556€ de r...

Les résidents luxembourgeois semblent s’accorder sur le fait que l’économi...

Un don de 5000€ pour Make-A-Wish grâce à #INGBestWishes

En décembre, dans le cadre de la campagne #INGBestWishes, des centaines de rêv...

Il n'y a aucun résultat pour votre recherche