Banks: Big bang or the theory of evolution?

With each groundbreaking innovation, players must adapt to survive. The banking sector is no exception to the theory of evolution. The financial crisis and new technologies have reshaped banking activities and models. Two factors are at play: prudential financial regulation and the digital revolution. With this new context, the question is towards what models will the Luxembourg banks move? Speakers from all around the world strove to take up this business challenge during the Banking Day, organised by PwC Luxembourg on 4 February.

Meeting the profitability challenge

Fragile growth, wild costs and low yields - the regulations go straight to the heart of banks' models. The sector has faced a volley of new measures since the financial crisis. The regulatory arsenal was particularly tough in areas aimed at preventing systemic risk (i.e. CRD IV) and investor protection (MiFID II). As a result, the profitability flag has slipped to half mast.

"Financial stability, capital and liquidity, the Banking Union and resolution mechanisms - the new regulations deployed since the crisis abound. These rules, coupled with extremely low rates, draw the sector’s profitability to the bottom. In less than a decade, banks have moved from a solvency challenge to a profitability one," said Olivier Carré, partner and Banking Leader at PwC Luxembourg.

New challenges are looming over the horizon as banks must invest in data quality in 2016. The resolution plan required by the first pillar of the Banking Union is probably the most obvious example. Banks have to fill in thousands of pages to prove they are strong enough to take on a crisis.

Another small revolution has turned bankers’ habits upside down. In the Banking Union, the European Central Bank is the sole supervisor and can review legislation, in collaboration with the CSSF.

Digital transformation: an essential strategy shift

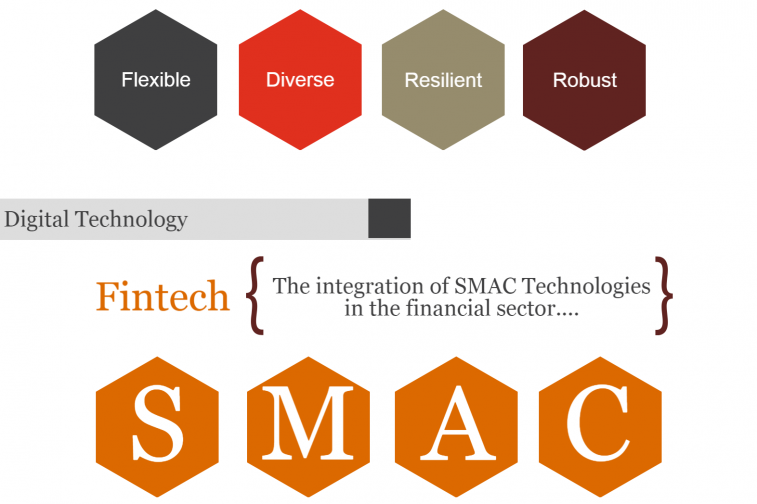

New technologies have reshaped consumers’ behaviour, instilling a new dynamic in terms of customer experience, services and products. The lower transaction costs on the one hand, and the strong regulation of banks on the other, opened the door to new players. Whether they are fintech companies or, more recently, telecom giants, these players provide pragmatic solutions for specific needs. Their offer is particularly competitive as they are web-based. The latest innovation in terms of investment is the "robo- advisors". These platforms of robotic financial advisors offer optimised assets allocation, according to the customers’ situation, their risk aversion, their financial objectives and their appetite.

"The algorithmic approach proposed by robo-advisors brings efficiency in building an investment portfolio and controlling it. However, it’s only the human advisor who can provide the essential cognitive understanding. The truth lies somewhere in the middle, between human intuition and effective technical solutions", said Grégory Weber, director and Fintech Leader at PwC Luxembourg.

Business models at a crossroads

The customer experience is undoubtedly connected. For traditional players, this means changing their business models. So, which way should the Luxembourg bank go to remain competitive?

What if the bank’s future was on the funds’ side? The country is an international centre for investment funds, with a confirmed prowess in terms of structuring.

"The market’s expertise in investment funds is an undeniable advantage that banks must seize. The future of the Luxembourg banking sector is at the junction of two worlds. Combining private banking and investment funds for new wealth planning solutions is definitely a promising niche", concluded Olivier Carré.

Communiqués liés

2023 : une année de transition et de transformation

Lors de l’Assemblée générale qui s’est tenue le 24 avril 2024, les acti...

Cargolux posts profit for 2023

The Cargolux Group (Cargolux) generated a positive net result for its 2023 finan...

Gcore Recognised as Highly Commended in the Industry Innovat...

Gcore acknowledged for successful launch of first AI speech-to-text solution for...

MOMENTUM 2024 drives sustainable solutions forward

Deloitte’s annual MOMENTUM Conference fosters a dynamic exchange between indus...

Nouvelle recrue au service client de NO-NAIL BOXES : Nadine ...

NO-NAIL BOXES, le fabricant luxembourgeois de caisses pliantes en bois contrepla...

Réseau ETRE est le nouveau lauréat du Degroof Petercam Fou...

Réseau ETRE remporte la sixième édition du Degroof Petercam Foundation Award....

Il n'y a aucun résultat pour votre recherche