PwC - CEOs Less Optimistic about Global Economy for 2015 but Confidence in Growth of Their Own Companies Remains Steady

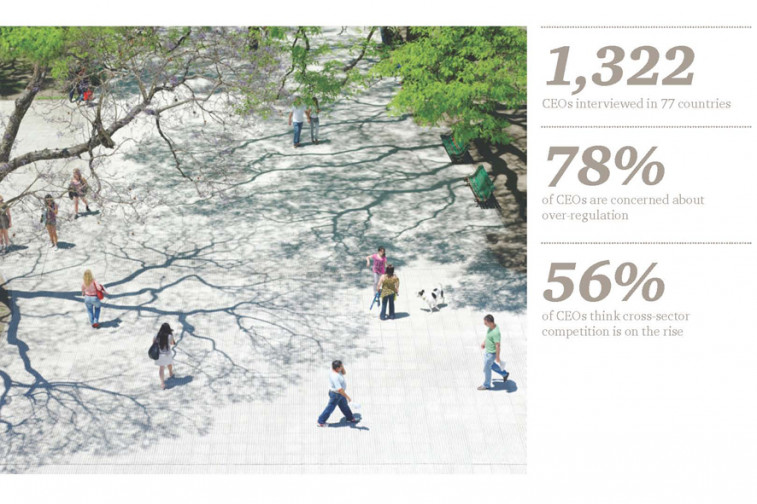

Fewer CEOs than last year think global economic growth will improve over the next 12 months, though confidence in their ability to achieve revenue growth in their own companies remains stable, say the more than 1,300 CEOs interviewed in PwC’s 18th Annual Global CEO Survey. Results of the survey were released today at the opening of the World Economic Forum Annual Meeting in Davos, Switzerland.

CEOs know they must be adaptable to disruptive changes in technology and in their markets. They need to put technology at the core of their business to create value for customers. Finding new ways of thinking and working in this new competitive landscape is critical to success

Didier Mouget, Managing Partner de PwC Luxembourg

Global Economy

CEOs are less optimistic about global growth prospects than a year ago, with 37% of CEOs thinking global economic growth will improve in 2015. This is down from 44% last year. Significantly, 17% of CEOs believe global economic growth will decline, more than twice as many as a year ago (7%). The remaining 44% expect economic conditions to remain steady.

Revenue Growth

Despite the overall declining outlook for the global economy, CEOs remain confident about prospects for their own company; 39% worldwide said they are ‘very confident’ their company’s revenues will grow in the next 12 months. That’s the same as last year; though up slightly from 36% in 2013.

Commenting on the survey results, Didier Mouget, Managing Partner of PwC Luxembourg, says: “The world is facing significant challenges: economically, politically and socially. CEOs overall remain cautious in their near-term outlook for the worldwide economy, as well as for growth prospects for their own companies. Luxembourg CEOs can rely on the country’s financial stability and triple A credit rating. Luxembourg has navigated the storm and performed well throughout the global financial crisis with a five-year average growth of 2.5%."

Strategies for Growth

CEOs rank the US as their most important market for growth over the next 12 months, placing it ahead of China for the first time. Overall, 38% 0f CEOs say the US is among their top-three overseas growth markets, compared with 34% for China, 19% for Germany, 11% for the UK and 10 % for Brazil.

CEOs say they will undertake a number of business strategies to strengthen their companies in the coming 12 months. Overall, 71% say they will cut costs, 51% will form strategic alliances or joint ventures, 31% will outsource a business process or function, and 29% will complete a domestic M&A (up from 23% last year).

What worries CEOs most?

Over-regulation again tops the list of concerns, named by 78% of CEOs worldwide. This is up 6 points from last year and is now at the highest level ever seen in the survey.

Other top concerns cited by CEOs are availability of key skills (73%), fiscal deficits and debt burdens (72%), geopolitical uncertainty (72%), increasing taxes (70%), cyber threats and the lack of data security (61%) - going up rapidly from 48% last year – as well as social instability (60%), shifting consumer patterns (60%) and the speed of technological change (58%).

The Digital Age

The emergence of digital technology has completely changed how companies do business; 58% of CEOs are concerned about the speed of technological change compared with 47% last year. Mobile technologies are seen by 81% of CEOs as most important to their company, followed by data mining and analysis (80%), cybersecurity (78%), socially enabled business processes (61%) and cloud computing (60%). Companies get the most benefit from digital technologies in the areas of operating efficiency (88%), data and data analytics (84%) and customer experience (77%).

“CEOs know they must be adaptable to disruptive changes in technology and in their markets. They need to put technology at the core of their business to create value for customers. Finding new ways of thinking and working in this new competitive landscape is critical to success,” concludes Didier Mouget.

The full survey report with supporting graphics can be downloaded at www.pwc.com/ceosurvey.

Communiqués liés

2023 : une année de transition et de transformation

Lors de l’Assemblée générale qui s’est tenue le 24 avril 2024, les acti...

Cargolux posts profit for 2023

The Cargolux Group (Cargolux) generated a positive net result for its 2023 finan...

Gcore Recognised as Highly Commended in the Industry Innovat...

Gcore acknowledged for successful launch of first AI speech-to-text solution for...

MOMENTUM 2024 drives sustainable solutions forward

Deloitte’s annual MOMENTUM Conference fosters a dynamic exchange between indus...

Nouvelle recrue au service client de NO-NAIL BOXES : Nadine ...

NO-NAIL BOXES, le fabricant luxembourgeois de caisses pliantes en bois contrepla...

Réseau ETRE est le nouveau lauréat du Degroof Petercam Fou...

Réseau ETRE remporte la sixième édition du Degroof Petercam Foundation Award....

Il n'y a aucun résultat pour votre recherche